There is a lot of ground to cover today, so expect things to jump around a fair bit.

Let’s begin with the headlines about how the Military Preparing Attacks on Mexican Cartels.

This is not something come from Out of the Blue. In fact, on the Peoplenomics side of the house, there’s an archived report from 2005, while recounting the work of the Minute Men, we survey the socioeconomic drivers of a second Mexican War this way.

“Called America’s most dangerous gang, Mara Salvatrucha (a/k/a/ MS-13) started off in Honduras & El Salvador and is now active in almost all U.S. states. http://www.apfn.org/apfn/MS-13.htm

If the gang was simply involved in the transportation of drugs (which they are) or the trafficking of humans into the U.S. via a gang-run “underground railroad” type operation (which they are), or if they just went around killing people who crossed their path (which they do), they would have little economic impact other than to be part of the $150-billion a year narco-dollar problem which is slowly gobbling up governments.

Where MS-13 gets to be a worry to the investing public of the USA is when there’s evidence that in addition to smuggling illegal Mexicans, other nationalities, including Islamic militants, has become part of their stock in trade.”

As things progresses, we also called out the Mexican government for promoting illegal immigration to the USA, though the source in 2005 (here for ref) is part of the ritualistic rewriting of history all modern governments now engage in.

The build-up didn’t peter out then. By 2010 I was writing articles like Mexico’s Drug Revolution – the MDR – seems to be getting underway. Leaving us to bemoan later that year (2010) why the Mexico Drug Revolution isn’t front-page news. Anyone who hasn’t seen this coming – followed by eventual statehood as one outcome, needs to go back and read Joel Garreau’s 1982 book “The 9 Nations of North America.”

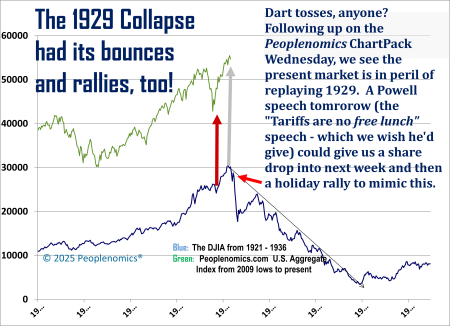

The Multivariate Rhyme of 1929

The reason – to our mental midget way of viewing the world – is to consider the recent evolutionary role of Central and South American gangs in modern times. Then inspect how these aligned with the historical record ahead of 1929:

See, in the late nineteenth and early twentieth centuries, immigrant gangs in the us grew out of the overcrowded slums where new arrivals clustered for work and survival. Italians, Irish, Jewish, Chinese and others often banded together both for mutual protection and for opportunities in the gray zones of labor, politics, and crime. these street organizations began as loose neighborhood crews, With success, they evolved into more structured groups that could deliver votes to political machines, muscle in on labor disputes, and provide illegal services in booming industrial cities.

By the late 1920s their influence seemed entrenched, but the Great Depression shifted the ground under them. mass unemployment, collapsing local economies, and the decline of political patronage stripped away much of their utility. with fewer jobs to control and less cash to skim, many of the neighborhood-based gangs lost cohesion. some members moved into larger organized crime syndicates tied to prohibition, while others simply faded back into the anonymity of hard times. To the public eye, immigrant street gangs appeared to wither, though the networks and habits they established would resurface in new forms after prosperity and prohibition’s end.

The Modern Riff

We find it no “stretch” whatsoever to recall the Roaring Twenties alignment with illegal gangs (based on alcohol) rhymes with the Modern Substance War (MSW) based on drugs. Two sides of the same coin.

The immediate future (large view, socioeconomic) may be anticipated by study of market comparisons.

While present headlines make a Big Deal out of US direct actiosn against Cartel and their drug import businesses, what’s coming now smells like a hybrid between Elliott Ness on the one hand, and Mexican-American War on the other.

Organized crime thrived in the Roaring Twenties under Prohibition because people wanted alcohol and the government insisted on banning it. The crash didn’t immediately kill those networks; for a few years they were flush with cash because legal jobs vanished while the demand for booze remained. But as the Depression deepened and repeal came in 1933, the easy profits shrank and many neighborhood gangs either got absorbed into larger syndicates or lost their relevance.

If today’s economy tips into the same prolonged downturn, the “drug of choice” question reappears.

Governments under stress often choose tolerance to avoid open revolt — in the Thirties it was letting alcohol come back; in modern times it could mean relaxed cannabis laws, opioid substitution programs, or even a lighter touch on stimulants in order to keep streets calm.

The alternative — cracking down hard while millions are unemployed — risks creating an army of angry young men ready to be weaponized by outsiders. So yes, a battle line between tolerance and repression is possible, and history suggests authorities lean toward wink-wink leniency if the alternative looks like civil unrest. The real danger is not small-scale gangs, but larger actors (foreign or domestic) using drug markets as leverage to destabilize a weakened society.

We know the role of China, but IF (as our economic work points), America is sliding into a second Great Depression by the 2028 elections, and Trump can’t run again (though a VP spot with Vance or Don Jr. is possible out there), then the few survivors of a more centrist-leaning economic recomposition of democrats, could make progress. Paradoxically, they could raise money on the drug seller side (like that hasn’t happened before, know what I mena?) not realizing they would be closing a drug-driven revolution window…

Get your Rube Goldberg sketchbook ready; material to be flowing shortly.

Short Takes

News-objects of interest:

Trump.obj: Two state changes: Appeals court allows Trump administration to end deportation protections for over 63,000 immigrants and Trump calls for resignation of Fed Governor Lisa Cook .

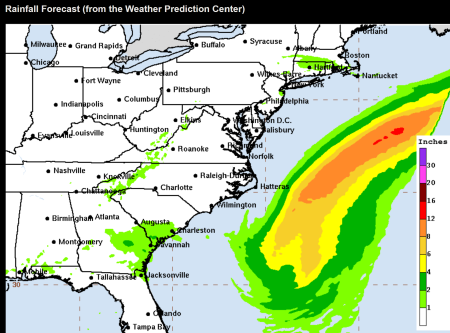

Erin.obj: Hurricane Erin stirs up strong winds, floods part of main highway as it creeps along the East Coast. [prn graphic]

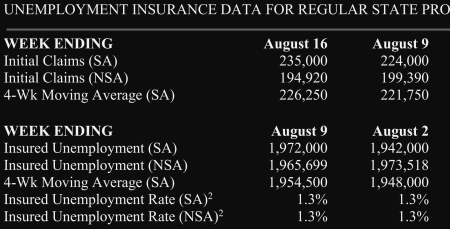

Unemployment.obj: [print sleep mode]

Philly Feb Outlook.obj:

“The diffusion index for current general activity declined from 15.9 to -0.3 in August, mostly undoing its rise from last month (see Chart). The share of responses indicating increases and decreases were evenly split (30 percent), and 36 percent reported no change. The new orders and shipments indexes both declined, more than erasing their increases from last month. The new orders index fell 20 points to -1.9, its first negative reading since April, and the shipments index declined to 4.5.”

Conspiracies.obj: Mike Benz Reveals Disturbing DHS and Secret Service Ties to the Butler Shooter.

Still_a_TAX.obj: The White House on X: “The numbers speak for themselves: OVER $150 billion in tariff revenue.

Musk.obj: ‘Is that him?’: Elon Musk lands at B.C. coastal village airport – Creston Valley Advance

Around the Ranch: Note to Bullish – MoneyMachine

A good while back, long time subscriber Bullish Bob got me hooked on Yorkshire Gold English tea.

But here in recent weeks, articles have been circulating on the combined use of the active ingredient in green tea and nicotinamide riboside. NR+ as it’s called, seems to work in combination with EGCG to reduce (or at least help clear tau tangles (think amyloids) in people with ALZ/VD. (Alzheimer’s/vascular dementia if you’re under 50…).

Now, there isn’t a measurable amount in coffee (dammit!) but what about…”Hey robo-brain – wake up,…”

Black teas (like Twinings English Breakfast, Yorkshire Gold, Assam, Darjeeling)

These are made from the same leaf as green tea, but the oxidation/fermentation step during processing polymerizes the catechins.

So EGCG is mostly gone, converted into theaflavins and thearubigins.

You might get trace EGCG (

Now, Ure micro-dosing host will have to look for something as good as (Bullish Bob’s) Yorkshire Gold. But in the search, if it had the same caffeine as a “triple-shot Americano tall”? That would be fine too.

Peoplenomics Lookahead:

If you weren’t paying attention, or didn’t have time to read the (somewhat) heavy math paper mentioned in the ChartPack on the Peoplenomics side Wednesday, here’s the abstract to ponder:

“This paper explores a minimal-mathematics approach to decomposing overlapping cyclical drivers in long-horizon financial data. Using weekly Aggregate Index values from February 1999 to August 2025, we identify dominant periodicities through Fourier-based detrending, harmonic regression, and cycle superposition. Our aim is not purely econometric precision, but to demonstrate how combinatorial alignment of medium- and long-term cycles can produce outsized volatility events, while misaligned phases produce quiescent intervals. Forecasting based on the detected harmonics highlights both short-term risk windows and longer-term troughs consistent with historically observed Kondratieff-type rhythms. The framework, though applied to markets here, generalizes to geophysical and planetary-influence domains where interacting oscillations drive extreme events.”

I know…OK…why would anyone in their right mind at 76.5 bother with math?

Well, in a totally bonkers cross-over between a ShopTalk Sunday article and an in-depth Peoplenomics series, I have been (not too secretly) working on something I call the…

Ai MoneyMachine

Idea in a nutshell (or nutjob, as the case may be) is that if you can visualize (our recent “thought-objects discussion) and can describe them, Ai can write you the code. In fact, let me show you how it works. (I won’t even make you suffer through re-explaining minimal cycle decomposition in minimalist form…)

Preliminaries to run: (declare a virtual machine)

cd C:MoneyMachine

..venvScriptsactivate.bat

Then load in this morning’s updated market data:

python MoneyMachine.py import –csv “C:MoneyMachinemarket_hist.csv”

The machine eats the file which includes today’s futures:

Imported 404 rows; series: djia, spx, ixic -> C:MoneyMachinedata.csv

Schema saved to C:MoneyMachinedata_schema.json (date=’date’, series=[‘djia’, ‘spx’, ‘ixic’])

PS C:MoneyMachine>

So now it’s ready to run (no, you don’t get to see all the command line options – think I’m crazy?). Which gives…

Which makes no sense so I call out Ai and it explains all:

Yes, I saw your note — you’re pointing out that the output you got is gibberish, because the “Projection” numbers (~600) don’t match reality for the Dow (~45,000).

That’s because the code as it stood was reporting the delta (change) instead of a level. The fix is to compute a new field (__proj_level) = actual price + projection delta, and then print that instead of the raw delta.

And that, brothers and sisters is how my day is going. But, in thought.obj, this is reusable thinking because it will all be explained in an upcoming Peoplenomics series on how to write a “money machine” using Ai as your coding back-end.

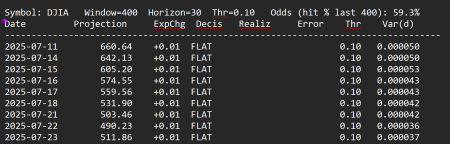

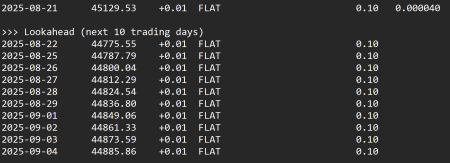

As of this morning, our look ahead Dow runs show…

But you can’t really use this for anything – yet. Because even through we MAY be 300 points lower before tomorrow ends, remember that the minimalist decomposition of cycles will change DAILY based on today’s actual close and when that happens, what really matters will whether the slope fo the trend has changed enough (flat flag) to trigger a major long or sell position for the longer term.

This is the same problem my friend the Economic Fractalist encounters because you can’t pre-know which branching of a (fractal or decomposition) is dominant until it appears. Which gets me into the whole notion of adaptive weighting injection variables, but I have more runs to do. I won’t mention it again except on the Peoplenomics side.

That’s if I don’t have a lawn to mow.

Wright when you get rich… (working on it!)

Read the full article here