TL;DR: Empire State data drops, retail may get a tariff-driven bump, and wage growth isn’t “soft” so much as shadow-boxing with inflation. Geopoliics grinds toward expanding war. Personal productivity and how to stall are covered.

Big Picture Economics

Note: Peoplenomics.com subscribers are reminded I posted a special update on Sunday, Click here to access. Or, here to subscribe.)

Big Picturing the Week

This ain’t hard.

Empire State Manufacturing data is just out. It supports the idea of a Fed cut because it dropped – a fair bit…

” The headline general business conditions index dropped twenty-one points to -8.7, its first negative reading since June. New orders and shipments fell sharply. Delivery times were steady, and supply availability worsened somewhat. Inventories edged lower for a second consecutive month. Employment held steady, while the average workweek declined modestly. The pace of input price increases was still elevated, though slower than last month.”

Previous Empire State numbers came in with a modest but clear improvement, the general business conditions index moving into positive territory again, suggesting that manufacturers in New York are feeling a little more confident than they have in recent months. Orders and shipments ticked higher while inventories eased back, painting a picture of a sector that is not booming but was showing signs of stability. We don’t think the chart looks too bad, really:

These numbers have limited potential to drive ahead of the FOMC number Wednesday after lunch. Between now and then? A decline betwixt now and then? That spells “sell the rumor” with a hint of being ready to “buy the news” – which is a maybe – if the Fed gives a half. No cut? Well, suddenly, those cycle charts in the special PN report get real.

Retail Looms Next

If the market can keep out of the ditch today, there’s a chance it will run off tomorrow because our sense is that retail will be strong and that’s because of Trump trembles tariffs. A lot of people (including us) pulled some forward parches into present to lock-in before any more inflation or tariffs,.

Retail Tuesday is more diffuse, since there is no single blockbuster release, but the ongoing dribble of earnings reports from large chains and consumer spending data continues to feed the broader narrative of how much strength remains in the household sector. Remember too: The CPI All Items less food and energy is more than a point higher than the much ballyhooed “target.” Was it all a sham? (Duh – isn’t it always?)

Markets are still balancing a story of resilient shoppers against the headwinds of higher borrowing costs (another media lie – rates are actually stable, but the media spin is in). Softer wage growth? Another misdirection with a bad fecal odor to it. Let’s get real, shall we?

-

“Tracking inflation” is often used loosely. Even if nominal wages are rising faster than some inflation indices, there are big “real world” gaps: taxes, benefits, housing/rent, healthcare, etc., which inflate the cost of living more for many people than headline CPI suggests. Yeash, CPI understates but that’s part of the Rich Screw Workers modality – never changes.

-

The averages hide variation: industries, regions, job types differ a lot. Low-wage workers may see wage gains, but if their living costs (e.g. rent, utilities, food) are rising faster, they’re still squeezed. Meanwhile some white-collar / middle-income sectors may be doing much better relatively. That’s because the greedster/syndicates have job jacked America out of factories – and now it’s our fault? FT. *(Hint: second word is that.)

-

Also, inflation measures tend to lag / smooth things; sudden cost jumps (fuel, food, housing) hurt people immediately, even if overall inflation hasn’t “caught up” yet. So “wage growth vs inflation” comparisons often miss that timing mismatch and real pain.

We would offer a “come to Jesus moment” is due Trump and Bessent: Tariffs is a good story but we’ve outed it all along: IT’S A TAX SCHEME. Tax imported stuff, But when domestic production returns, it will be robotics and AI. People aren’t as stupid as politicians think…

Even without a headline-grabbing surprise, the steady flow of consumer metrics gives Wall Street something to chew on as it tries to handicap how long the buying public can keep carrying the expansion. We’ve said it before:

- If Crypto is so damn useful, why isn’t it pooling to fund development? Why the Fed…why taxpayer money? FTW (Hint: last two words are those whales.)

- Lowering rates will only fund IPOs – which ought to stand on their own two feet first. AI is already running into User Resistance – over-promising and under-delivering. What the hell are we rewarding mediocrity and greed for with a rate cut?

- (Anyone ever drug test the FOMC? Check for blackmailing? Search for insider trading of not only members but related parties like family? Umm…just saying, there’s a whiff of something…)

The Guardians of You Consciousness should be on high alert for suggestions like “…policymakers will acknowledge slower inflation momentum without overstating recession risk…” What kind of gobbledygook is that?

Yeah it’s a big deal. Load up on Astroglide. If you’re over 70? Wesson Oil?

Life Under the Bus

Looks to us like New York State is about to set up it’s version of the Kremlin: New York governor endorses Mamdani for mayor

Another strike (on another country) is rumored to have already been green-lighted. So it’s almost Kabuki to read how Rubio promises ‘unwavering support’ for Israel in Gaza goals, Be looking for the next move which could be Israel shutting off all water supplies to Gaza. Not genocide? Um… Anyway, if country #2 is struck, we assume that will be the second of the three countries to attack Israel that seems to be the buzz in forward-projecting, prophecy, and look-ahead sites. Only thing we’re wondering is when will Egypt get involved?

Second War Coming Notes: DJT is trying to see if Europe will walk their talk. As you read Trump says he is ready for major sanctions on Moscow – when Nato gives up Russian oil, ask yourself “Will the arrogant royals and bunglecrats running Europe into the ground will ‘do without’?” And frankly, we’re confused that mid-war, Ukraine did what? Young Ukrainian men rush to Polish border as Kyiv relaxes war restrictions. Depopulating Ukraine before…(the mind races…)

Speaking of arrogant Royals: knee pads at the ready? Prince Harry’s 41st birthday wish may be royal family reconciliation. Now? Why now? Something close?

Just a fine solution: FAA Proposes to Fine Boeing $3.1M Over Widespread Safety Violations

Yet somehow, it’s all supposed to make sense: This satire on X sums up the world.

But, if you prefer reading to watching, might we offer: IMAGES, WORDS & NARRATIVES MATTER – The Burning Platform

Something Book Length? A classic? Battle of Symbols: Global Dynamics of Advertising, Entertainment and Media by John Fraim. With that, along with Positioning: The Battle for Your Mind‘ (Ries & Trout) you now know enough to ignore noise and run your own life.

Now let’s segue into the “shoptalk” version of life management, shall we?

Around the Ranch: Personal Organizers & Teardrop Stalls

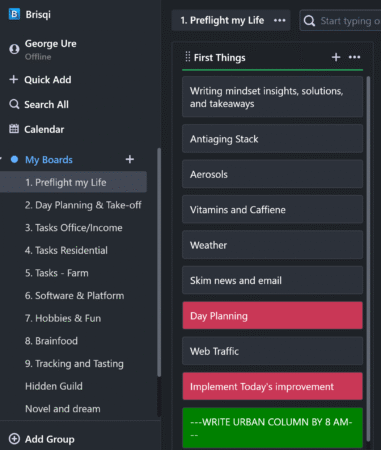

A note on personal organizers. I have written many times around Brisqi – which is my long-time Kanban PIM favorite. Been mentioning it off and on since 2022. Point is, there’s a new update out and slick as ever – Ash and crew have done well, again.

A note on personal organizers. I have written many times around Brisqi – which is my long-time Kanban PIM favorite. Been mentioning it off and on since 2022. Point is, there’s a new update out and slick as ever – Ash and crew have done well, again.

People occasionally ask me: “How do you get everything done?” Answer is simple: if either the brain or body isn’t in motion you’re a lazy person! (Duh!) So every day begins with my personal pre-flight: (right)

Brisqi is free to begin, modestly priced, and it’s just awesome.

The “aerosols” on my morning Kanban? Those of things like lavender essential oil if I am running high of BP, otherwise different oils for clarity and action.

My son G2 isn’t a big Kanban user. He’s more on the neu-minimalist rack. He has coffee and picks his “magic 3” for the day and commits to getting them done, no matter what.

Sure, sure..works. Until life get complicated enough. I need my onboard cores to be working on at-hand tasking and optimizations because the more I can offload into Brisqi and my Ai stacks, the more time I have on the Cal Newport stuff (“Deep Work” “Digital Minimalism“) which is where the rubber meets the road around here.

Small nit with Newport, if I may be so bold. Digital Minimalism will teach you the how (and importance) of not letting your life get sucked out a wireless card. But, AI has left the wireless cards here in “no sleep” mode. Because our track is “Digital Purposefulness.” A simple “Unplug the bullshit, focus on the outcomes you can nail with minimum effort.” And that’s where my next book – Mind Amplifiers (and the website) are going.

And yes – serialized as Peoplenomics episodes – including this week…

The Answer Man is In

A great one popped in to our Comments section overnight:

Question.

Canada geese arrive from farmland daily usually before 11am. Small groups ie; two or four land without any change in flight.. Large flocks come in to this Great Lake and approximately 75% at 50 -80 feet do a 45,90 or 180 degree brief flip before smooth landing. Any airplane history on this?

This will also be of interesting to Fleet-Uber-Admiral, retd. Egor, who also gets the Canadian Bird visits…

The simple answer is YES!!!

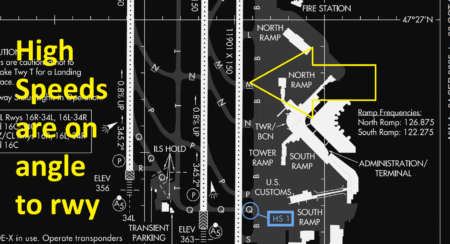

I would imagine this is the CG (C-geese) analog to the tower command “take the high-speed” – On big airports,. there is often a 30-degree, or so turnoff so when the tower would be me “Musketeer 7912-Lima, keep your speed up on final and take the high speed…” that would inform me that “Big plane’s right behind and I need to get down and off the runway right freaking now…” (Once you take a high-speed, you’ve still got room to burn off a lot of momentum before you get to a perpendicular taxiway.

Take a fairly busy airport – like the three runways in Seattle:

All though angled light gray taxiways are designed to a) get aircraft off the active runway and b) get them into the terminal gate areas quickly. After a lot of small single-engine time you learn to “land long” because if you do set it down in 500-600 at the far end of the runway, you’ll taxi all day. Which is entertaining in a new city but NOT on a hot day with the sun beating on you and holding the doors open for cooling…

OK, that is one analog. This explains your 45-degree guys and maybe their 90-degrees.

But, what about those bothersome 180s?

For this example, we turn to crop dusters – a hardy and ballsy group if ever was. They make their living doing something called “teardrop stalls”

Basic stalls and recovery is here: Power-off Stall: Recovery Steps Made Easy – Pilot Institute

And almost teardrop is in this video at 1:50: Crop Duster Full Field Ride-Along – YouTube Except that this is a modern crop duster (with flaps). Older a/c – like the post WW II Steerman N2N torpedo bomber (no flaps) – were the more common application of teardrop stalls which hardly anyone knows about, any more.

Procedure?

Let’s imagine spraying along the length of a field, so north to south. When we get to the south end, kill the spreader, pull back hard on the yoke, and go nearly nose-vert. At that point, hard over on the stick (left or right rudder) and the inboard wing (whichever side) will stall first, and the plane will “fall off” that way. It’s similar to the entry into a simple Lomcevak (“headache”) maneuver in aerobatics. Note the fall off to the left wing here: The Lomcevak / Tumble at Fighter Combat International

Down low, you push the nose back down quickly (no time for the Lomcevak rolls and tumbles!) You need to preserve momentum because close to the ground, you will NOT want to run out of “airspeed, altitude, and ideas” at the same time [that defines a crash].

As the airflow reattaches to the stalled wing, (you will see the ground coming at you through the windscreen) you bring the nose up, but not too fast, or you can enter a secondary stall. Which down low has a bad outcome.

This is likely what your Canadian Geese are doing – making sure everyone has room to land in the big flocks – and they have the (aircraft carrier f/w ops) analog in that they can fold their wings up in a hurry, as well.

Hope this helps?

ShopTalk Sunday is here, if you missed it. Tool sharpening (written by a tool?)

Write when you get rich,

Read the full article here