TL;DR: Our “big rally” came by early in the Thursday session and promptly left town. Now our Fractalist pal warns of worse while moving averages blink. In denial, I consider writing a children’s book. But even that’s…well…You’ll see.

Markets Before Rehab

The Fed’s “intake counseling” results will pop in December with the rate meeting. But for now, the Street can’t figure out who, or how, to blame for recent instability. Let’s run it down before today’s talking Fed-heads festival:

Crashes Never Happen from Tops

October 29th (this year) our Aggregate Index hit its (so far) all-time high: 60,258.33.

They often – as in 1929 – really get into panic mode 55-days out from there.

Sitting down? 55 days from October 29, 2025 is December 23, 2025, which falls on a Tuesday.

Now go back and look at the model case we yammered about on the Peoplenomics subscriber side earlier this fall. Slaughter of the Elves II. That’s where we reminded you that oh, yeah…2018 was not a rousing finish to that year.

But What Do Moving Averages Say?

In our work – which is never financial advice (that’s on you) – the market which seems most rational is actually the NASDAQ. When we study this for “magic oval” hints, and for crossings of moving averages, sometimes the tea leaves will line up.

Remember that moving averages are not how humans remember. Something called the Ebbinghaus-Ure model sees a link, but it’s in an advisory – don’t spend your milk money on it – way. Details are found over here.

Our research, using this dandy approach, Cycle_Decomposition_Academic_Paper_With_Math. When I plugged this into my MoneyMachine (a Python programming “class project” on the Peoplenomics side of the house), it kept telling me markets were about 2X their justifiable price and we should have collapsed from September.

Since we didn’t, then Ure was wrong, right?

Well, not so fast. Off stage we can hear the Fat Lady singing. Bitcoin dropped to $81,793 overnight. On a planet where everything is cross-linked, it’s like arguing which of 20-monkeys fighting over the steering wheel causes the accident.

Still, If You Insist – Here’s the Problem

The 50 DMA on the NASDAQ is broken. Moving averages matter. In our own mischief we like the 35 and the 42 DMAs. Grown-ups like the 50 day and 200-day moving averages. But the 85-day moving average (17 weeks) backtests really well.

A couple of outcomes from here? One offers that we can rally back up to the 50 DMA (kiss of death) and then start down. You’ll want plans to car-jack Santa, if that’s the case.

The other says Trump and Powell won’t let the system crash. Which is a nice, optimistic ‘tude.

BUT Historical Field Position Sucks

We’ll do the 1929 match up on the Peoplenomics ChartPack tomorrow. Unwrap the updated “Ghosts of 1929s past…”

Just realize – going into today – every shill out there is grabbing dogs and trying to find a tale to wag or weave. A big rally now – from the 85 – and we might put the covers back on the lifeboats and send the widows and orphans back through the buffet line.

But if we rally above it – and turn down after? That, my friend, is when Slaughter of the Elves, II comes front and center.

For now, we’re just pondering a flash from the Stl. Fed last night:

- The U.S. unemployment rate ticked up to 4.4% in September from 4.3% in August. More precise data show the rate increased to 4.440% from 4.324%, respectively.

- More people entering the labor force to look for work primarily drove the rise in September’s reading.

- Despite the modest increase in the unemployment rate, relatively strong payroll gains in September suggest no alarming softening in the labor market.

“T’was the night before Christmas, and all through the house, not a dollar was flowing, and people did grouse.

“The Fed said “Free Money! It’s not such a scare” But a hard sell it was when the cabinets were bare.”

Why, it sounds like I’m getting tuned-up to write a Children’s Book, already…

Credit Card Grease

Credit Card Grease

“Ready to whip it out next week, honey?” Grease them credit cards.

Walmart raises profit expectations as American shoppers hunt deals.

Walmart, TJX earnings: Wealthy shoppers seek value.

And, since early last month, we have been patiently waiting to link you to 2025 holiday shopping insights.

Meanwhile, from the Grinch’s Midtown stronghold: December Rate Cut in Doubt as Fed Fault Lines Deepen, Minutes Show – The New York Times. Leave it to the liberal press to throw a little cold water on a nice serial bubble, huh?

Cue Mary Poppins now with the “spoonful of sugar makes the medicine go down:” as Vance pleads for ‘patience’ on the economy in sharp departure from Trump’s rhetoric.

Our staff econometrician, Ben Dover, summed it up this way:

Credit card rates won’t ease until the Federal Reserve goes even crazier on rate cutting — for Vance’s high-roller pals — and even then, banks will lag. (How long you planning to live?) The earliest window would be mid-to-late 2026, assuming inflation cools and short-term Treasury yields drop. Assumes no nuclear war, sans pandemic too, as false flags to cover-up collapse and blame-shift…

Credit cards are tied to the prime rate, which follows the Fed funds rate almost lockstep. With core inflation still sticky and election-year spending ahead, the odds of meaningful cuts before next summer are thin. Even if Powell blinks, lenders will likely hold APRs high to rebuild margins lost during pandemic stimulus and rising defaults. Think prime +20 percent? Might ballpark it.

Longer term, credit card APRs may never return to pre-2020 levels. Structural inflation — energy, rent, insurance, and labor — has reset the floor under interest rates. Add risk pricing for higher consumer delinquencies and bank capital rules, and “20% APR” could be the new normal.

A sustained fall in rates would require both economic contraction and policy overreaction, the kind that hurts enough to scare the Fed into rescue mode again. Short of that, expect the credit card business to stay in permanent extraction mode — easy credit, hard terms, and endless minimum payments.

The good news? Those are exactly the fertile ground for a Depression – and then we’ll all have a lot more time to think instead of writing free content for the billionaire boys clubs to monetize on social media…

Spew Amplifiers

Years ago, when the city was dead, a bunch of us old-time reporters on the City Hall beat would go to a Councilman and make up news. “Did you hear was countilmember (so and so) said about you?” Roll tape, grab the insults. Now run back to the (madeup) source and play the tape. Rinse, repeat, and fill up three minutes on radio or a 5-minute standup on the 5-o’clock TV news shows.

Advanced urinalism training now – spin on the old school ways – if you read Coast Guard will no longer classify swastikas, nooses as hate symbols – The Washington Post and then (playing back louder) Coast Guard cool with swastikas and nooses now, says report dailykos.om.

Never needs to be a real story. Just emotional and grabby. Just enough to trigger a “trying to be woke, Trump-hating click-storm. That’s where the eyeballs are – and that’s the money play, right there.

Time for Cynicism Meds?

Let me guess. A democrat judge? US judge moves to halt Trump’s National Guard deployment in Washington, DC. Yep. Biden appointee. Which will (likely) lead to a finding the Guard has to go followed by an appeal, followed by more headlines to fill up the tree-cutting media’s ad space between the Thanksgiving, Black Friday, Cyber-Monday, Christmas, and New Years ads. The illusion of self-importance is a frigging wonder, ain’t it?

We’ll skip the morning census of the Venezuelan drug fleet and the holiday chill map, thanks.

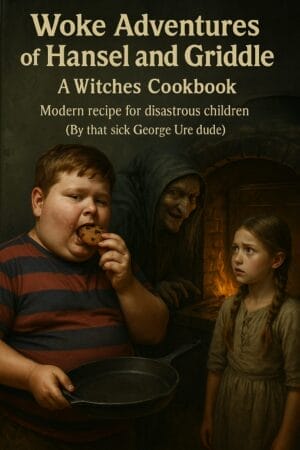

Around the Ranch: My First Children’s Book

A shout-out to the Bitcoin Nazi who, long-term readers will remember, was still huffing and puffing when made up money was up in six figures. We were warning him then that “Rehab will come for you…” And so, kissing $82,000 overnight, it has.

But it’s not just him that Rehab may be stalking. I might make it to the short-list, myself. Here’s why. My first attempt at a Children’s book…

Snow White and the Seven Streaming Services

In the pixelated hellscape of a subscription-saturated netherweb, where algorithms devoured souls and data caps choked the masses, reigned Queen Streama—a venomous exec in her 40s, Botox-frozen face cracking under LED lights, body a graft of black-market implants from canceled creators.

Her empire? A monopoly of paywalled poison, harvesting user eyeballs for ad auctions and organs for elite VR transplants. But her stepdaughter, Snow White—a glitch-born influencer at 19, skin pale from 24/7 blue-light binges, lips red as error codes, hair black as voided bandwidth—went viral.

Her free streams of raw, uncut truth nuked Streama’s metrics. “Mirror, mirror on the darknet,” the Queen snarled at her AI oracle, “who’s the fairest streamer?” “Snow White, bitch—her subs eclipse yours.”

Fury ignited.

The Queen hired a hitman-hacker, ordering: “Delete her drive.” He cornered Snow in a server alley, but her doe-eyed plea—and a flash of cleavage—froze his code. Instead, he carved out her tracker chip, left her for dead in the bandwidth woods with a poisoned USB apple: “One plug-in, eternal crash.”

Snow staggered, hunger glitching her implants, until she crashed at a ramshackle data den: home to the Seven Streaming Services—dwarfed pirate coders, each a twisted trope of the trade.

- Sloppy: A drooling mess, beard crusted in energy drink spills, coding in his own filth, leaking torrents like diarrhea.

- Droppy: Twitchy frame dropping frames constantly, shows buffering into oblivion, always mid-sentence.

- Garfinkel: Gargling static, a hoarder of garbage files, tinkling malware chimes, eyes milky from porn overload.

- Buffering: Perpetually loading, slow as dial-up, muttering “99%… 99%…”

- Lagging: Jerky movements, rubber-banding through life, rage-quitting at shadows.

- Pirating: Hook-handed thief, sails rickety ships of bootlegs, parrot squawking CC numbers.

- Cancelled: Bitter ghost, shows axed mid-season, haunting with unfinished arcs and unpaid residuals.

They nursed her with bootleg bandwidth feasts—ripped rom-coms laced with nootropics, binge marathons boosting her dopamine.

Snow synced her channel to theirs, views exploding. But the Queen spied via drone cam. “Skin as white as algo snow? Lips like ruby redirects? That viral whore!” She disguised as a glitchy vendor, hawking the poisoned USB: “Free upgrade, darling—plug and play forever.” Snow bit—er, inserted. Crash. Coma. Flatline stream.

The Services mourned, propping her in a cryo-cabinet amid fairy lights and fan art. Enter the Prince—a rogue VPN heir, cruising for uncensored content and living outside of Texas.

He kissed her screen—literally, hacking a neural jolt. Snow awoke, spitting code. “Time to uncancel this bitch.”

Revenge raid on the Queen’s tower. Snow and the Seven stormed in: Sloppy flooded servers with fecal emojis; Droppy lagged her firewalls to seizure; Garfinkel tinkled viruses into her veins; Buffering stalled her escape; Lagging yo-yoed her guards; Pirating stole her keys; Canceled narrated her downfall in voiceover doom.

The Queen cornered Snow, mirror shattering: “Eat this final fork!” But Snow jammed the poisoned USB into the Queen’s port—her implants fried, body convulsing in electric agony, flesh melting like overrendered CGI.

They harvested her empire: petabytes of pirated gold, organs auctioned to the highest bidders. Snow wed the Prince in a metaverse ceremony, the Seven as viral bridesmaids. The net whispered of the fairest slayer.

Moral? (Wouldn’t be a kid’s book without one, would it?) In the stream, beauty’s just bandwidth deep—but revenge buffers eternal. And sometimes, you poison the source. Other times, your cards are max’ed and you’re just f*cked.

I’ve always wanted to be in the room when Hunter S. Thompson, Mark Twain, Stephen King, and Edgar Alan Poe did a children’s book. Sadly, this grimm attempt will have to suffice.

Write when the sugar plum fairies get naked. (Don’t forget the Wesson oil and metformin.)

Should you tire of our Gonzo-Financial Noir for the Digital Apocalypse, try the visitor center or the old writer’s content morgue. (They’re holding a spot for the writer, too.) If you were under the wrong impression about the “TA” here, this is where technical analysis is spoken. Perhaps you were thinking of Page Six?

Read the full article here